A type of chart that is widely used in binary options trading and that better describes the price movements are the Candlestick charts, also called Japanese Candlestick charts. (You may also want to read Candlestick Charting – The Basics – Part 1).

There are also important candlestick patterns. Every pattern represents the market trend in a particular time period. There are bullish patterns and bearish patterns. The bullish patterns indicate that an upward price movement is expected. The bearish pattern means that most investors expect a downward price movement. There are reversal candlestick patterns and continuation candlestick patterns.

Today am going to introduce the first two types of reversal patterns: the Hammer and the Hanging Man patterns.

But first let’s see what reversal pattern are?

Reversal patterns usually indicate that a trend reversal is taking place. It is not necessarily an inversion signal; it may also indicate the beginning of a stagnation period (sideways) that may end with a continuation of the existing trend or with its reversal in opposite direction.

In order to be considered as a signal of the trend inversion, the reversal patterns have to be followed by confirmation candlestick lines.

The basic reversal candlestick patterns are:

– The Hammer and the Hanging Man patterns

– The Doji line

– The Engulfing pattern

– The Dark-Cloud Cover

– The Piercing pattern.

Let’s start with the first two – the Hammer and the Hanging Man patterns.

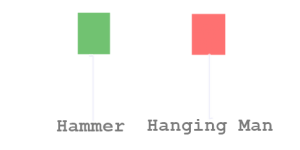

Hammer and Hanging Man

A Hammer is a candlestick pattern that consists of just one candle (although with candlesticks it is always best to view them in context of the candlesticks around them – in particular the candle that follows immediately after).

The hammer, as well as the hanging man candle, has a long lower wick, short body, and little or no upper wick. Strictly speaking, the lower wick should be at least two times longer than the body – the longer, the better. And depending on where you find it on a chart, it is called either a hammer or a hanging man.

A hammer can be found in a downtrend, and signals a bullish reversal. The long lower wick shows a period in which sellers were in control, but the body shows buyers coming back in. From this we can tell that there is strong buying by bulls as the period of sell-off declines.

As with all single candlestick patterns, we should wait for next candle to confirm that buyers are in control.

Here’s an example of a hammer pattern:

This is a chart for a chart for Eur/USD. Note how the strong selling action and increased volume (indicated by the long lower wick) on the candlestick is reversed as buyers come back in. The green candlestick opening above the body of the hammer confirms the bullish trend.

A hanging man is the same shape as hammer, but found in an uptrend. We don’t expect to see strong selling pressure (seen in the long lower wick on the candle) in an uptrend, so here it suggests a change of market sentiment and a reversal to downside.

Here’s an example of a Hanging Man pattern:

This is a FTSE 1-minute chart. In this case, the hanging man shape coincides with the indices showing the price to be overbought, and the next candle confirms the trend.

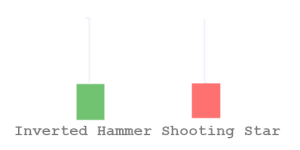

Sometimes it is possible to identify candlestick patterns similar to the hammer and the hanging-man patterns, but with the real body at the bottom of the candle. These are called Inverted Hammer and Shooting star patterns.

Inverted hammer is a is a candle with a small body and long upward wick, signally a possible reversal. Where it appears in a chart affects whether it’s an inverted hammer or a shooting star.

An inverted hammer forms after a downtrend or at the bottom of a period of consolidation. The reversal isn’t confirmed until you have a bullish candle in the next period.

A shooting star forms after an uptrend or at the top of a period of consolidation.

Inverted hammers and shooting stars can have green or red bodies – what’s important here is that the body size is small, that the upper wick is at least twice the length of the body, and the lower wick is negligible.

To be continued…

If you find this article useful, please comment below and share it with your friends!

More interesting stuff to come ?